08/05/2020

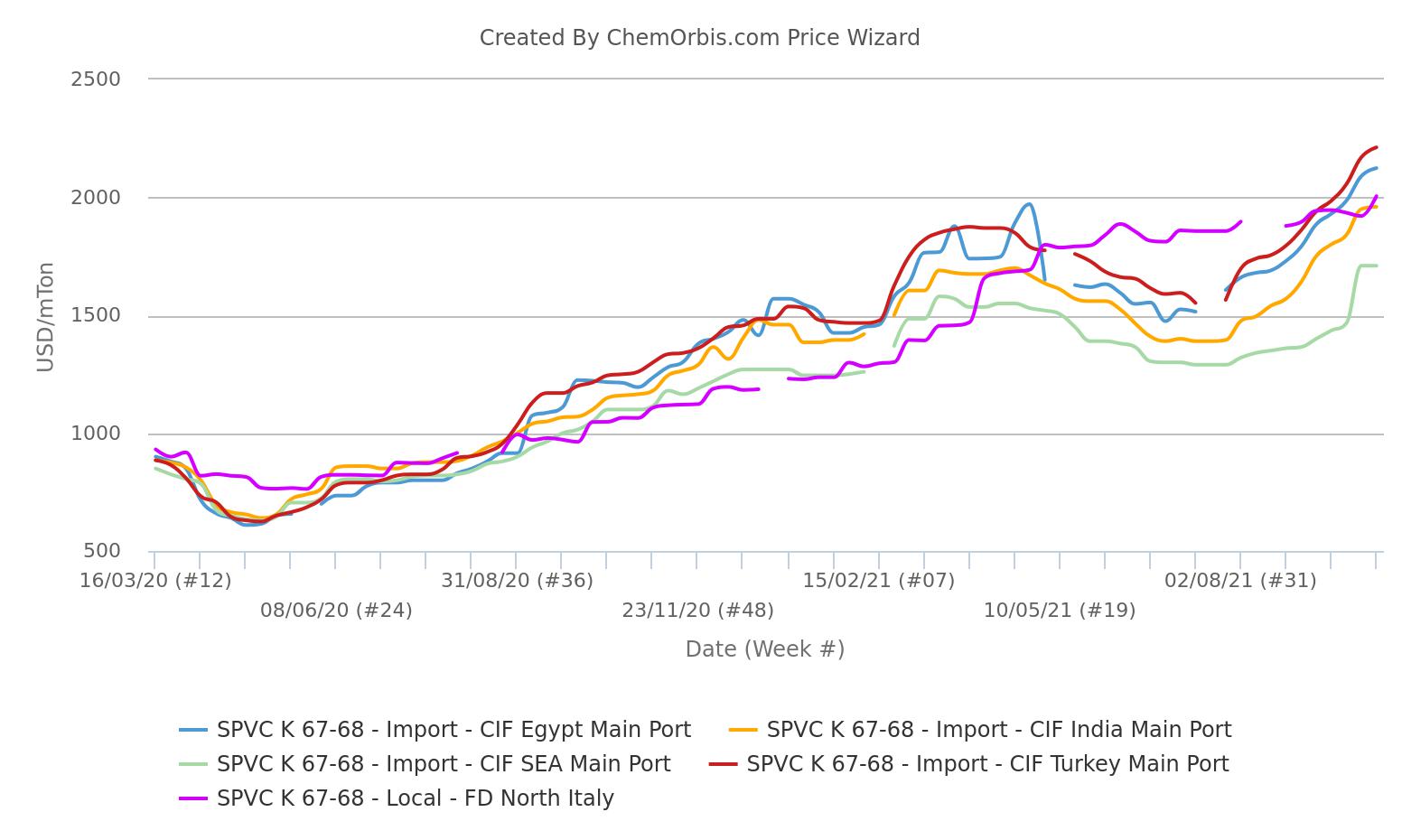

08/05/2020 In recent times, the price of PVC has continuously fluctuated strongly. The upward momentum in PVC prices taking place globally, mainly since the second quarter of 2020 continues to gain momentum. The worldwide PVC market has been hitting record highs every week. This is an unprecedented period in the PVC market, a long-term challenge for Vietnam's PVC industry. Picomat also cannot avoid the influence of the PVC price increase wave. However, Picomat has always tried to stabilize product prices during recent times.

The Asian PVC market hit a new record high this week as prices continued to climb as a shortage of containers slowed import flows, tightening supply. Although the markets were mostly quiet because of China's "Golden Week" and the November announcement from a major Taiwanese manufacturer, the bullish trend continued for another week. The main problem in the market remains the scarcity of containers in Asia. Traders say even FOB quotes cannot be transacted because buyers do not have containers to ship. This means longer delivery delays and higher freight charges. In addition to the lack of supply, the rise in coal and crude oil prices also creates a cost push for the market. Meanwhile, demand in Southeast Asia is recovering as economies are opening up.

PVC price rally extends into 17th month in Europe

Domestic PVC prices in Northwest Europe and Italy extended their upward momentum into October, marking 17 consecutive months of price increases. Regional sellers have asked for an increase of around 50-120 EUR/ton in October, much higher than the ethylene result of 25 EUR/ton. According to ChemOrbis Price Index data, the PVC market in the region hit a new record high shortly after the most recent bull run. Supply remains tight in Europe due to ongoing maintenance operations and force majeure circumstances. Meanwhile, demand is reported to be strong as suppliers receive orders from the window profiles, flooring, cable, medical, and piping industries.

Low supply pushes Egypt PVC market to new high

In Egypt, the domestic and imported PVC markets hit a new record high this week. The lack of quotes from China due to the country's holiday season coupled with limited supply from the US continued to support the upside momentum. Market participants say the uptrend in PVC prices is likely to remain until year-end as there is no sign of real relief for supply or logistics. It added: “The shutdown of production in China because of energy restrictions means a decrease in supply from the country.”

Turkey remains above other import markets

The price of PVC K67 imported into Turkey continues to be above other markets including India, Southeast Asia, China, and Egypt. The Turkish CIF K67 price hit a new record high this week, as did in other markets. Despite record profits, the Turkish PVC market is likely to continue to face supply constraints as the market is still unable to attract large volumes from foreign or domestic suppliers. neighborhood up to the present time. According to market participants, this could be because demand in Europe remains strong as factories shut down while material flows from Asia are hampered by container issues.

Source: synthesis

16/09/2022 Nhựa tự tiệt trùng tiêu diệt virus

16/09/2022 Nhựa tự tiệt trùng tiêu diệt virus